Free the Hops: Sin Taxes Drive Up the Cost of Beer

This article was featured in our weekly newsletter, the Liberator Online. To receive it in your inbox, sign up here.

Your favorite frothy adult beverage would be a little cheaper if sin taxes were not part of the equation, according to a new report from the Tax Foundation, a nonpartisan policy research center.

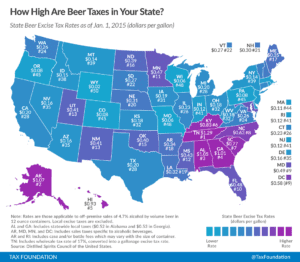

Each state taxes beer by the gallon, with the costs ranging from just 2 cents in Wyoming to $1.29 in Tennessee.

“State and local governments use a variety of formulas to tax beer,” Scott Drenkard writes at the Tax Foundation. “The rates can include fixed per-volume taxes; wholesale taxes that are often a percentage of a product’s wholesale price; distributor taxes (sometimes structured as license fees as a percentage of revenues); case or bottle fees (which can vary based on size of container); and additional sales taxes (note that this measure does not include general sales tax, only those in excess of the general rate).”

There is a trend to be found in the rates, as well. States in the Southeast tend to have the highest beer taxes. Seven of the top 10 states with the highest beer taxes are located in the area of the country known as the “Bible belt.” Northeastern states tend to have lower beer taxes.

The Beer Institute estimates that consumers pay $5.6 billion in federal and state excise taxes annually. “Surprisingly, taxes are the single most expensive ingredient in beer,” the beer centric think tank notes, “costing more than the labor and raw materials combined.”

Although the Tax Foundation report does not touch on the cost of federal and state regulation of beer, which adds to the cost of production, particular of micro-breweries and small craft beer producers.

In a June 2014 editorial at US News, Matthew Mitchell and Christopher Koopman, both research fellows at the Mercatus Center, explained that the excessive regulations, which are just another form of taxation, create burdensome barrier to entry for small brewers looking to take their product to market.

“Once in business, brewers face more hurdles. Among the least efficient regulations are the ‘franchise laws’ that restrict their ability to sell beer directly to consumers, instead mandating that they sell through distributors. These rules can even dictate how brewers may contract with distributors,” wrote Mitchell and Koopman. “For example, some grant distributors exclusive territories, and others limit the ability of a brewer to choose to work with someone else. A recent survey found that in most cases, these rules make consumers worse off.”

Beer taxes may be an easy target for lawmakers looking to raise revenue for big government programs and regulation may be a convenient way to protect big beer brewers, but these policies are keeping Americans from the frothy goodness that is their favorite brew. Raise a glass and tell your lawmakers to “free the hops!”