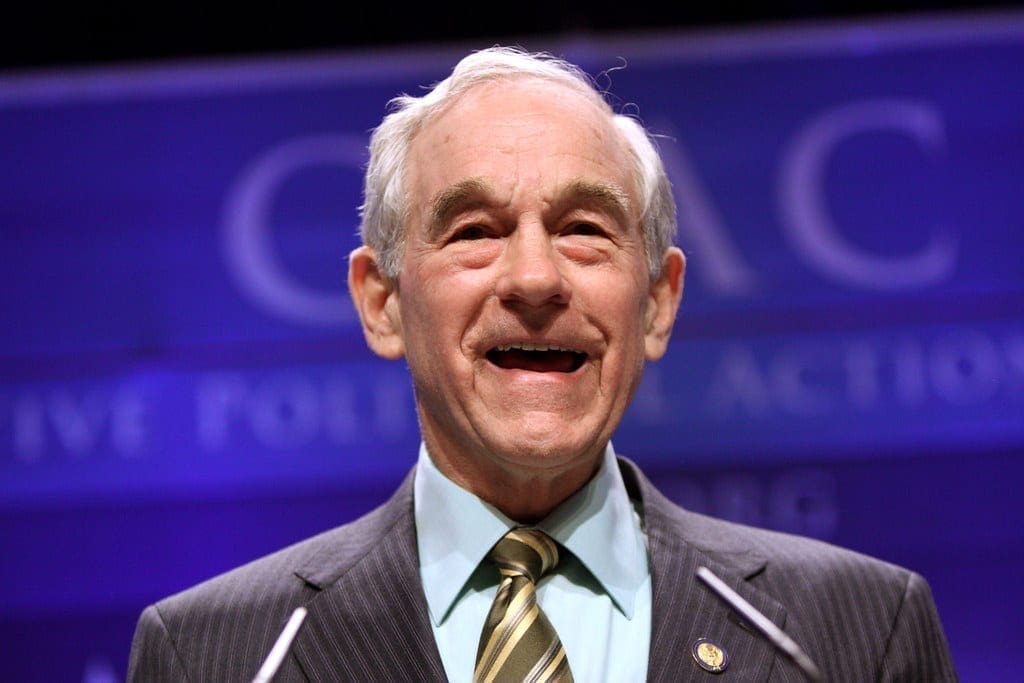

Ron Paul warned about “the mother of all bubbles” in a recent piece arguing that the U.S. may be on the verge of experiencing a catastrophic economic crisis.

In his piece titled Is the ‘Mother of all Bubbles’ About to Pop?, Paul declared, “When the sovereign debt bubble inevitably bursts, it will cause a meltdown bigger than the 2008 crash.” Paul specifically blames the New York Federal Reserve, which started to inject billions of dollars into the repo market in September. Initially, the repo pump was supposed to go on for a few weeks. However, the New York Fed added $62.54 billion to overnight bids on Wednesday, November 6, 2019.

For clarity’s sake, repurchase markets are where borrowers looking for cash provide lenders with collateral—safe securities in this case. As economist Daniel Lacalle puts it, “The repurchase rate (repo) is the interest rate that is paid to borrow cash in exchange for Treasuries for 24 hours.” Repos are generally used to raise short-term capital and are one of the few instruments the Federal Reserve uses to conduct open market operations. Open market operations — where the Federal Reserve buys and sells U.S. Treasury securities — ultimately determine the money supply. By buying Treasuries, the Federal Reserve is able to increase the money supply, which is at the heart of the boom and bust cycles the U.S. has repeatedly faced.

Paul blames the New York Federal Reserve for its continuous interventions in the market. Banking policy tends to fly over people’s heads, but understanding it is crucial in order to truly grasp the flimsy foundation of the U.S. economy. Paul ultimately believes in the eventual demise of the dollar. He has been warning about the dangers of easy money since he entered Congress in 1976. Like many adherents of the Austrian School of Economics, Paul understands how central banking enables massive increases in government spending and other forms of state expansion. Now, the U.S. might be reaching a fiscal tipping point. According to CNBC, the total deficit for the fiscal year 2019 stood at $984 billion.

Just like everyone takes policies like the income tax as a given, the inflate-and-spend policies present in D.C. have tremendous support among both the public and the politicians. It will require a groundswell of support from the public or a grave external crisis to force the political class to act.

However, the ideological dominance of statism may keep Congress from making the right decision. If history shows, demagogic politicians take advantage of political crisis to usher in their own interventionist schemes. One common tool they use is currency depreciation. In times of fiscal turmoil, increasing the money supply is a more politically palatable option than cutting spending or raising taxes. Of course, this brings even bigger economic problems as inflation comes into the mix and gradually erodes people’s savings.

This economic nightmare is avoidable, but it will involve making tough decisions. That means cutting spending, lowering taxes, and moving toward sound money like gold. These steps are far-fetched at the moment, but they must be taken if we want to stave off a crisis that will condemn our posterity to economic misery.

Future generations deserve better.