On June 30, 2025, in a flurry of celebration and side deals, Congress passed what insiders now call the Big Beautiful Bill. In short, it’s a sweeping package that some are arguing, showers the wealthiest Americans with significant tax reductions.

On the other hand, for the average citizen, it appears to offer little beyond the comforting hum of televised celebrations and that familiar Washington refrain: “Trickle-down works!” Yet, as our tax code bends to favor the ultra-rich, we must ask: Is economic freedom really being defended? Or is this just another gilded cage, disguised as liberty?

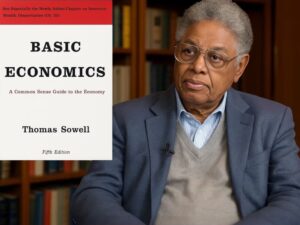

Thomas Sowell’s Radical Clarification

If you’ve ever felt lost in the thicket of economic jargon—supply-side, Laffer Curves, static versus dynamic scoring—you’re not alone. Enter noted economist Thomas Sowell’s short book, Trickle Down Theory and Tax Cuts for the Rich, a mere twenty-two pages of intellectual dynamite.

Sowell demolishes the straw man of “trickle-down economics” and lays bare the real mechanism: tax cuts change behavior. He shows, with crisp historical data, that the rate cuts under presidents Coolidge, Kennedy, Reagan, and even G.W. Bush often raised revenue, because investors no longer scrambled for tax shelters and instead put capital to work.

“No such theory has been found… either in name or in essence,” Sowell writes, exposing the myth that high earners somehow hoard their gains. In fact, when taxed less, Sowell argues, this wealthy demographic invests more—and in doing so, they create jobs, expand businesses, and yes, replenish the Treasury. It’s not benevolence; it’s human nature responding to incentives.

The Straw Men of Class Warfare

For decades, opponents of tax reform have retold the trickle-down narrative as if it were gospel: “The rich get richer; the poor stay poor.” Yet Sowell reminds us that the true villain is not the investor but the distortion of policy debates by political scorekeepers.

Class-warfare rhetoric sells votes but erects barriers to rational dialogue. When we demonize entrepreneurs, we obscure the fact that the government itself can be the biggest parasite—levying punitive rates that stifle innovation and drive capital abroad.

Consider the 1920s, when cuts on incomes above $100,000 slashed rates from 73 percent to 24 percent. Between 1921 and 1929, revenues doubled and the proportion paid by the wealthy soared because they were finally free to invest domestically, rather than warehouse their wealth in tax-exempt bonds.

Sowell says opponents seized upon the term “trickle down” precisely to misrepresent this success.

Austrian Economics: The Freedom Framework

While Sowell writes in clear, journalistic prose, Austrian economists like Ludwig von Mises, Friedrich Hayek, and Israel Kirzner are more philosophical in their espousal of tax policy freedom. They generally view taxation as a coercive transfer, an infringement upon property rights that distorts prices and misallocates capital.

Austrian theory’s core insight is that market processes—the invisible hand of supply and demand—rely on accurate price signals. When the tax code favors debt financing over equity, or real estate over R&D, it warps those signals, leading to boom-bust cycles and wasted resources.

In this light, the Big Beautiful Bill’s gift to hedge-fund managers and global investors is not just a fiscal maneuver. Rather, it’s an ideological statement, one where those with the most capital deserve the best deals while others feel like they’re left with having to “make do.”

True sovereignty, however, requires neutrality in tax policy—a level playing field where voluntary exchange flourishes without political favoritism.

What’s your political type?

Find out right now by taking The World’s Smallest Political Quiz.

Milton Friedman and the “Starve the Beast” Strategy

Milton Friedman, though labeled a monetarist rather than an Austrian, captured the same spirit: “I am in favor of cutting taxes under any circumstances and for any excuse.”

His logic was simple—pinch the Treasury and you’ll constrain the Fed’s appetite.

Yet Friedman also warned against the simplistic belief that tax cuts always pay for themselves. His permanent income hypothesis suggested that only lasting reforms—deep, structural changes—shift behavior, while temporary gimmicks leave consumers unfazed.

The Big Beautiful Bill, with its mixture of permanent top-rate cuts and sunset provisions for the middle class, feels very much like a bait-and-switch: long-term relief for the wealthy, but short-lived aid for the rest.

Friedman would have sniffed that out instantly, reminding us that true reform demands consistency, not political theater.

Critics, Dissenters, and the Skeptical Voices

Of course, not every economist is sold on supply-side triumphalism. Nobel laureate Joseph Stiglitz and New Keynesians warn that tax cuts can exacerbate inequality without guaranteeing growth. They point to evidence that capital mobility means global elites can shift profits offshore, diluting domestic benefits.

Even some Austrians caution that in a hyper-globalized world, rate differentials matter less when trillion-dollar funds roam sovereign wealth funds with impunity.

Yet here’s the rub: critics often ignore the behavioral insights that Sowell and the Austrians emphasize. They model outcomes in static, closed-economy vacuums, rather than observing real-world responses. This disconnect leaves room for populist demagoguery. But it doesn’t invalidate the core truth that incentives matter.

Sovereignty in Action

At its core, a free society hinges on the ability of individuals to think for themselves, unbound by ideological dogma. True liberty extends beyond speech or belief—it includes the freedom to direct the fruits of one’s labor.

Any serious evaluation of the Big Beautiful Bill must rise above partisan noise and instead be grounded in fundamental principles: voluntary exchange, property rights, and the right to retain what you earn. From this lens, a tax system that punishes innovation or productive risk-taking is as corrosive to autonomy as restrictions on speech or peaceful assembly.

The essential question ultimately becomes: do these tax cuts expand individual freedom, or do they merely reinforce entrenched hierarchies of wealth and influence? If the bulk of benefits accrue to those already holding disproportionate power, then we’re not witnessing a liberation. Rather, we’re watching a quiet consolidation that chips away at the sovereignty we all share.

Freedom for Whom?

I remember the day I first read Sowell’s book and was struck—how liberating it felt to see through decades of demonization. It was as if someone had handed me a mirror in a smoky room, letting me see the real forces at play.

Since then, I’ve observed every tax debate with the same skepticism: who stands to gain, who’s shutting down dissent, and how my own pocketbook must not be the sole measure of justice.

Because here’s the kicker: true freedom isn’t just about larger paychecks for the few. It’s about opportunity, mobility, and the right to pursue one’s calling without stifling regulations or stealthy taxes. It’s about retaining enough time, money, energy and other resources to explore, innovate, and build community on our own terms.

The Cultural War Over Tax Narratives

Why, then, does rational debate remain so rare? Partly because storytelling often trumps data.

It’s easier to paint wealthy investors as villains than to explain marginal tax rates and revenue elasticity. The result is a cultural deadlock: half the country sees tax cuts as corporate welfare; the other half sees tax hikes as an assault on liberty. Meanwhile, the real battleground of behavioral incentives goes unaddressed.

We must break this impasse by reclaiming the narrative. As Sowell shows, historical evidence can pierce the veil of rhetoric. As Austrians teach, philosophical rigor can restore the moral high ground. As we advocate for self-government, individual sovereignty must guide policy, not special interests.

Sovereignty, Solidarity, and the Next Frontier

So where do we go from here? First, demand transparency: require the Congressional Budget Office to score dynamic, behaviorally-informed models, not just static projections.

Second, champion tax neutrality by exploring flat, broad-based systems that minimize distortions and resist the endless carve-outs that benefit cronies.

Third, foster civic literacy. This might include encouraging everyone, particularly students, voters, and neighbors to read Sowell’s pamphlet, to dive into Hayek’s essays, to challenge the talking heads we encounter with hard questions.

Finally, remember that freedom is never free. It demands vigilance, intellectual courage, and the willingness to swim upstream against popular delusions. If we treat tax policy as the linchpin of sovereignty, we reclaim the conversation from demagogues and bureaucrats alike.

We remind our fellow citizens that power flows to those who hold the purse strings—and that we, the people, must decide whether that power empowers us all or entombs us in gilded cages.

In the end, The Big Beautiful Bill may polish the influence of the wealthy, but it risks dulling the freedom of the rest. Thomas Sowell and the Austrians show us that tax cuts, when done right, can fuel growth and spread opportunity.

But the greater mission espoused here is that liberty lives in the choices we make, the stories we tell, and the vigilance we maintain. So let us choose wisely, think critically, and vote not for the next political short-termism, but for the enduring promise of self-sovereignty.

Diamond Michael Scott is an independent journalist and an editor-at-large for Advocates for Self Government. You can find more of his work at The Daily Chocolate Taoist.

What do you think?

Did you find this article persuasive?