After the Second World War, South Korea was devastated and heavily reliant on foreign aid. Its largely agrarian economy had limited industrial output. In an attempt to jump-start economic development in the 1960s, the Park Chung Hee administration selected a handful of companies for extensive government support—the start of the chaebol system.

Over the decades, the number of chaebols, literally “wealth clan,” has always remained in the dozens. They borrowed extensively and diversified into many unrelated industries. During the 1997 Asian financial crisis, investors lost confidence, and capital flight ensued, leaving many chaebols on the brink of bankruptcy.

This exposed deep structural flaws in the chaebol system. Instead of letting market forces take their course, politicians were quick to step in and bail out these firms.

Today, the four largest chaebols—Samsung, SK, Hyundai, and LG—account for over 40 percent of South Korea’s GDP. The thirty largest business groups comprise more than 76 percent.

That is what too big to fail looks like. South Korea’s economic problems stem not from market failure but from sustained state intervention.

When the next crisis hits in your country, and bailouts are demanded once again, remember South Korea.

‘Saving Jobs’

When a business goes bankrupt, the consequences can be devastating for its employees. When a large corporation fails, the effects can ripple through a whole region or an entire economy.

A politician’s stated intention to save the economy or create local jobs may seem virtuous, though oftentimes, policymakers are driven less by “the public good” and more by the interests of their cronies. Even so, one might ask: Isn’t protecting the economy a noble aim?

Unfortunately, this noble aim ignores the vital economic role played by bankruptcy.

Simply put, a bankrupt company no longer creates value. It consumes more than it contributes. It wastes resources. Every enterprise experiences losses at times. But if a business cannot sustain itself through these periods and political allies must intervene with a bailout, that signals a fundamental flaw in the business model. Its continued existence amounts to ongoing resource destruction.

This isn’t to say the company produces nothing of value. The chaebols sure do. But on balance, bailouts and continued subsidies lead to a misallocation of resources and penalize the very individuals whose productivity sustains our wealth.

Bailouts Everywhere

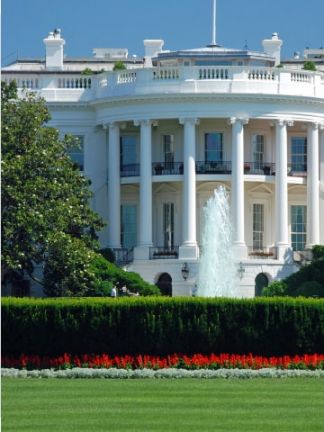

While bailouts, interventions, and rescues have occurred several times over the last few centuries, the practice of propping up failing businesses with resources siphoned from the productive economy has accelerated significantly in recent decades. Though it is a global phenomenon, nowhere is this trend more pronounced than in the United States.

During the Great Depression, large refinancing programs were launched to support mortgages and stimulate employment.

In 1979, Chrysler was bailed out to prevent massive job layoffs and preserve defense manufacturing capacity.

In the late 1980s and early 1990s, Savings & Loan institutions (S&Ls) were rescued after years of risky real estate deals left them unable to meet their interest obligations.

Then came the 2008 financial crisis, when hundreds of billions of dollars were injected into major banks that had failed in their basic responsibility to manage risk. Smaller banks, run by prudent managers, were left to compete with zombie institutions artificially sustained by government intervention. Those who had done the right thing—not gambling with their customers’ mortgages—were punished.

And most recently, following the Covid lockdowns, governments all around the world feigned surprise when they discovered that businesses fail if they are prohibited from operating. Of course, there was only one solution: using some duct tape as a short-term fix and starting the largest bailout programs the world has ever seen… so far.

You get a bailout. And you get a bailout. Everyone gets a bailout.

In every case, the underlying problems weren’t solved; they were preserved and exacerbated.

Socializing the Losses

Imagine a child running a lemonade stand. It serves sour, lukewarm lemonade. After two weeks, it has no customers left. If its parents keep funding the operation and encouraging it, the kid will never improve the recipe and start learning from his mistakes.

Likewise, if a nation distorts market signals and refuses to let failing companies go bankrupt, it fosters chronic irresponsibility. Corporations are incentivized to act recklessly, confident that political rescue will always be there to cover for serious missteps. They just need to ensure that they are sufficiently large and well-connected.

When risk-takers can keep most of their profits but don’t have to face their losses, a perverse incentive structure emerges: privatized wins and socialized losses. The companies continue to benefit, and you are forced to pick up their irresponsible bar tab.

Free markets require both the prospect of gains and the risk of losses. When big corporations fail, a vacuum is created that new businesses—those that use resources more wisely—can fill. Protecting the inefficient at the expense of the productive hinders innovation and progress.

What’s your political type?

Find out right now by taking The World’s Smallest Political Quiz.

Expiration Dates: The Sunk Cost Fallacy

What applies at the macro level often holds true at the micro level. Sometimes, the wisest approach is to cut the cord. Don’t sink more money, time, and energy into a losing cause.

That side hustle that drains weekends, taxes your psyche, and fails to cover its costs—let it go. If you do it for fun, carry on. But if you cling to it because you can’t admit failure to your friends, maybe it’s time to find better friends. And if you continue because you can’t admit failure to yourself, it may be time to stop attaching your identity to this venture.

That liquid asset whose price keeps dropping—the one you’re holding in the hope that it may break even one day—let it go. When it comes to assets you can sell at any time, you are effectively choosing to reinvest every day that you don’t sell. If the fundamentals are intact, short-term price swings don’t matter. However, if you’re just waiting to “get your money back,” you’re not investing; you’re gambling.

That friendship you’re still clinging to, long after its expiration date—maybe it’s time to end it. You can find new, better friends. There are people who share your values and interests—people who will energize your life.

Apply market forces to your own habits. Nurture the ones that generate real returns—the ones that strengthen your relationships, fuel your growth, and give you purpose. Cut out the ones that drag you down—doomscrolling, complaining, and procrastinating.

If you don’t let go of the old, there’s no room for the new. Innovation requires space. For seedlings to bloom in the spring, nature must surrender its leaves in the fall and rest through to winter.

Let It Burn

If your goal is improvement, you mustn’t perpetuate failure. This holds true both in your personal life and in civilization at large. In the short term, change is difficult. In the long term, change is not only manageable but essential.

Bailouts may offer short-term relief, but they create what economists call moral hazard, in which one party will take risks knowing that another party will bear the costs. This results in long-term instability.

Rescuing failing enterprises turns the economy into a museum. It preserves inefficiency and blocks progress, creating bad incentives for incumbents and potential innovators. Why avoid risks when failure is subsidized?

Small businesses and startups cannot possibly compete with corporate giants that can use their political connections to shield themselves from the consequences of their mismanagement. Innovation needs failure to clear the way.

Let innovation rise from the ruins of the weak.

The curious task of economics is to demonstrate to men how little they really know about what they imagine they can design.

With a background in business and tech, David brings clarity to ideas of individual freedom and Austrian Economics. He left Europe in search of liberty and he authors the Substack publication "In Pursuit of Liberty."

What do you think?

Did you find this article persuasive?