The Revival of the Austrian School: A 50-Year Remembrance

Fifty years ago, during the week of June 22–28, 1975, a group of mostly young economists interested in the Austrian School of Economics attended a conference at the University of Hartford in Connecticut. This was the second time that many of them had gathered together. They had met a year earlier in the small village of South Royalton, Vermont, over the week of June 15–22, 1974.

That earlier meeting has often been designated as the “first” Austrian Economics conference, due to the fact that for most of the period following the Second World War, the Austrian School had gone into eclipse after being considered one of the most fruitful and insightful approaches in matters of economic theory and policy during the last decades of the nineteenth and the first half of the twentieth centuries.

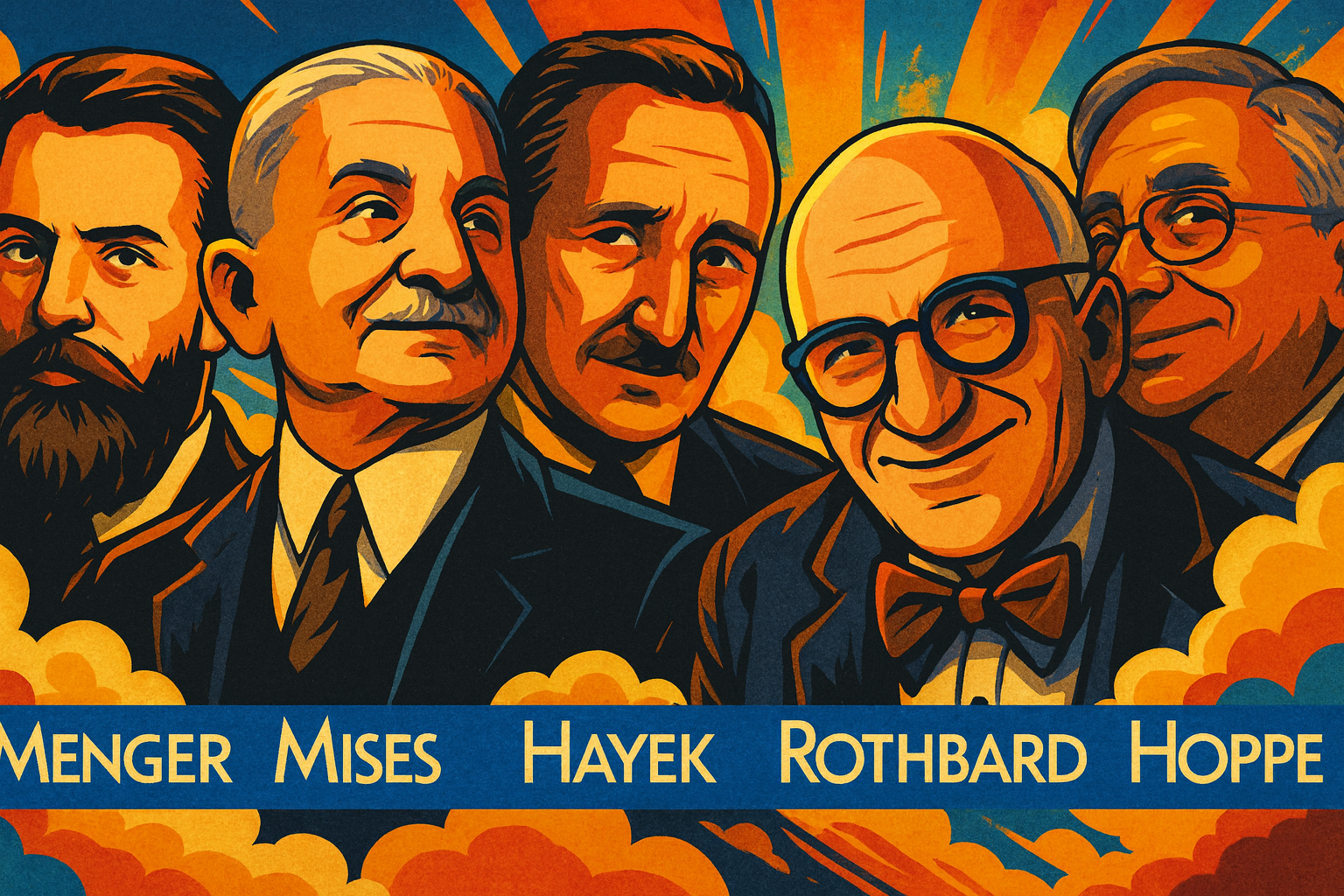

Founded by the Austrian economist Carl Menger (1840–1921) with his 1871 book on the Principles of Economics, in the years before the beginning of the First World War in 1914, the Austrian School was considered to have helped to revolutionize the foundational ideas of economic analysis. In place of the labor theory of value of the classical economists, from Adam Smith to John Stuart Mill, Menger was one of those who developed the idea of “marginal utility.”

The value of goods and the prices at which they traded in the marketplace is not determined by the measured quantity of labor that goes into the production of each good offered in exchange for each other. Rather, it is the “subjective value” of the importance that people place on the availability and use of goods to serve their individual purposes that determines what something is worth to them, and therefore the valuation they place on the means of production to produce them and their value in trade for other goods on the market.

Menger’s followers and the Austrian School

Menger was followed by two younger economists, Friedrich von Wieser (1851–1926) and Eugen von Böhm-Bawerk (1851–1914), who were inspired by Menger’s ideas to take them up and develop them further. Wieser, for example, is the one who coined the term “marginal utility” and argued on the basis of Menger’s reasoning that cost is the next-best alternative foregone in every choice an individual has to make. It is the individual’s subjective valuation of what the scarce means to achieve any desired end is worth in terms of what he would have used them for if not for the goal or end for which he, in fact, applied them. It is the opportunity forgone in using scarce means for one purpose rather than another.

Böhm-Bawerk took up another strand of thought in Menger’s work. Menger had argued that all human activity occurs in and through time. All production activities to bring a desired good to market passes through a period of production that invariably entails various interconnected stages of production on the way to the completion of the desired good. Böhm-Bawerk applied this to develop a detailed and intricate theory of the processes of savings, investment, and capital formation through time. As part of this, he offered a theory of people’s “time preference,” that is, the value they place on the satisfaction of desired ends in the present versus further in the future to explain the origin and determination of the rate of interest in the marketplace.

Their common set of ideas resulted in their being referred to as the Austrian economists, though this label was, in fact, first bestowed upon them by their critics and opponents among what was called the German Historical School of economics. Nonetheless, this tag has served ever since to designate and distinguish those economists who built upon the ideas of Menger, Wieser, and Böhm-Bawerk over the last 150 years.

Mises and Hayek the guiding Austrian stars

In the 20th century, the leading and most famous contributors to the Austrian School were, no doubt, Ludwig von Mises (1881–1973) and Friedrich A. Hayek (1899–1992). Part of their contributions were given international recognition in the autumn of 1974, when Hayek was awarded what is usually called the Nobel Prize in Economics, the year after Mises died.

Their contributions fall into three areas. First, the theory of money and the business cycle. It was originally developed by Mises before the First World War. But in the interwar period of the 1920s and 1930s, Mises’s formulation and then Hayek’s, when he was a professor at the London School of Economics, became a major contender for explaining the causes and duration of the Great Depression. They argued that the origin of the Depression had its roots in the mismanagement of the money supply by the Federal Reserve in the 1920s.

Manipulating the money supply in pursuit of a misguided attempt to try to stabilize the general price level, Federal Reserve monetary and interest-rate policy resulted in a mismatch between real savings and investment that set the stage for the need for an inescapable correction to rebalance the economy. But rather than leaving markets alone to recoordinate supplies and demands, government interventions hampered the necessary market corrections, which led to a snowballing collapse of production with rising unemployment. This was intensified by a series of higher and higher tariff barriers by all the major countries of the world that started with the American Smoot-Hawley tariff of 1930, which brought about a dramatic implosion of international trade.

Austrians lose out to the Keynesians and socialists

But in the mid and late 1930s, the Austrians found themselves fighting and losing to two counter-approaches — the rise of Keynesian economics and the appeal of socialist central planning. John Maynard Keynes argued that free-market capitalism was inherently unstable and subject to periods of high and lasting unemployment, which was only correctable though activist government fiscal and monetary spending to ensure “full employment.”

The socialists were insistent that capitalism was a disaster and doomed “the workers” to misery. Only its replacement by government planning could ensure stability, growth, and economic fairness. In their second major contribution, Mises and Hayek argued in the 1920s, 1930s, and 1940s as to why any and all forms of central planning were inherently unworkable by doing away with market institutions of private property, competition, and prices, without which the value of things could not be determined for rational and efficient use of scarce means to serve the ends of consumers.

But the Austrian theory of money and the business cycle was overwhelmed by what one economist called the “Keynesian avalanche.” At the same time, designing and planning “the future” through government planning was appealing to politicians, bureaucrats, and intellectuals who were dreaming of being the masterminds behind the new world to be created by a political paternalism under their control.

Mises’s and Hayek’s third contribution was their theory of the free-market process. The marketplace is an arena of dynamic competition, with entrepreneurial innovation and discovery always bringing new and better goods to the consumers and bringing changing supplies and demands into coordinated balance with each other. But the mainstream of the economics profession focused on an unrealistic notion of static “perfect competition,” which rationalized the need for government intervention and regulation to ensure “optimal” and “just” social outcomes. The Austrian view was swept away here also.

The 1970s revival of the Austrian School

Thus, from the late 1940s and into the 1970s, the Austrian School of economics came to be viewed as an irrelevant and closed chapter in the history of economic ideas. But beneath the surface, the possibility for an Austrian revival was emerging. Ludwig von Mises, who had immigrated to America in 1940 due to the rising tide of Nazi totalitarianism in Western Europe, found new students interested in his ideas, especially Israel M. Kirzner (b. 1930), Murray N. Rothbard (1926–1995), and Hans Sennholz (1922–2007). By the 1960s and early 1970s, they started publishing books and articles in defense of an emerging new Austrian approach.

This led to the Institute for Humane Studies (IHS) organizing that first Austrian conference in South Royalton in June 1974, at which a series of lectures were delivered by Kirzner, Rothbard, and Ludwig M. Lachmann (1906–1990), who had been a student of Hayek’s at the London School of Economics. The lectures were soon after published as The Foundations of Modern Austrian Economics (1976). (See my article, “The Beginnings of a Reborn Austrian School of Economics, Future of Freedom, December 2023.)

Because of the enthusiastic response of those who attended the conference, IHS decided to sponsor a Symposium on Austrian Economics at the University of Hartford during that week of June 22–28, 1975. Rather than having a series of lectures by the “senior” Austrian theorists again, the format was one of papers by “young” Austrians. Some of the informal lectures that were also presented at the South Royalton event were so impressive that it was decided to ask some of the up and coming “Austrians” to deliver what came to a total of 15 papers during the week at Hartford. Commentators on the papers included Friedrich Hayek, Murray Rothbard, Israel M. Kirzner, Emil Kauder, Leland Yeager, Percy Greaves, W.H. Hutt, D.T. Armentano, and Lawrence Moss.

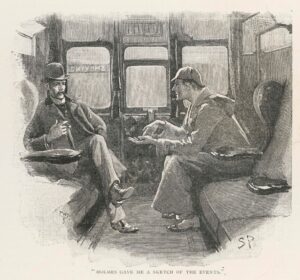

The week began with an opening evening banquet with a keynote address by Hayek, who gave his reflections and recollections of the Austrian School. He talked about the founding of the school by Menger and the intellectual atmosphere of Vienna in the late 19th century; what it was like to study in the seminar of Friedrich von Wieser and the University of Vienna; his close relationship with Ludwig von Mises and the turbulent years of the interwar period. He recalled that 40 years ago, he would have hesitated to label himself an Austrian economist. He and his fellow Viennese theorists took pride in the fact that what had been an “Austrian” tradition was swiftly becoming part of the standard economic orthodoxy.

The Austrians, looking out from Vienna, were so thrilled by the seemingly “Austrian” twist that economic theory was taking in general that they failed to notice that other trends were starting to develop as well. In fact, Hayek confessed:

Though I was publicly involved in the controversies of the day with Keynes, for a very long time I did not realize that the main difference between Keynes and myself was not over particular points of theory, but very real and ultimately fundamental differences in approach. Keynes had marked, in effect, as far as the public was concerned, a transition from microeconomics, with its methodological individualistic roots, to a macroeconomics which looks for the forces behind events among observed causal connections between statistical magnitudes. It was just this development, very much to my regret and against all my wishes, which has justified that we now again revive the name of Austrian Economics…. I’m sure that it will prosper and succeed.

The differences between Hayek’s economics and Keynes’s

The papers at the symposium covered topics as far ranging as methodology, the history of Austrian economics, the theory of competition, international economics, problems concerning the trade cycle, and Austrian analysis applied to contemporary problems. Since many of the presentations were never published or in forms that did not receive wide circulation, it seems that the 50th anniversary of this event offers an appropriate opportunity to appreciate at least some of the ideas being developed at the rebirth of the Austrian School.

One of the points of “high drama” in the history of Austrian economics was the debate between Hayek and Keynes in the 1930s. Gerald O’Driscoll, who wrote Economics as a Coordination Problem: The Contributions of Friedrich A. Hayek (1977), delivered a paper on “Hayek and Keynes: A Retrospective Assessment.” The central error in Keynes’s approach, O’Driscoll argued, was the attempt to analyze dynamic economic problems in a static equilibrium framework that implied the existence of stable macroeconomic relationships. The emphasis and search for aggregate relationships between such magnitudes as investment and consumption, investment and income, and consumption and income resulted in the total neglect of the microeconomic foundations of economic activity and, in particular, microeconomic relationships involving production decisions. The difficulty of Keynes’s analysis was multiplied by the ambiguity and contradictions in his use of concepts and his inability to distinguish between changes at the level of firms as opposed to the economy as a whole.

The differences between Keynes and Hayek were crystalized in their theories of investment. For Keynes, looking at everything in a macro-aggregated way, all capital goods were perfectly interchangeable means to produce “output” as a whole. Instead, investment goods, in Hayek’s view, are seen as a complementary pattern of interrelated stages of production involved in a dynamic process over time. Thus, changes in the rate of interest (which is supposed to reflect consumer preference for consumption and savings, i.e., consumption in the future) will affect the choice of utilizing different forms of investment structures across time.

The stages of production will become longer and more roundabout and will form a completed tapestry of a capital structure only if the resources needed to complete and sustain the more complex capital patterns are available through additional savings. In Hayek’s words, from his “Reflections on the Pure Theory of Money of Mr. J. M. Keynes” (Economica, February 1932), “It seems never to have occurred to him [Keynes] that the artificial stimulus to investment, which makes it exceed current savings, may cause a disequilibrium in the real structure of production which, sooner or later, must lead to a reaction.”

What’s your political type?

Find out right now by taking The World’s Smallest Political Quiz.

Government manipulation creates unemployment

The general theme of errors from investment decisions was discussed further by John B. Egger in his paper, “Information and Unemployment in the Trade Cycle.” In the Austrian framework, the market process is seen not as a movement from one equilibrium state to another but instead as an ongoing discovery procedure. Individuals decide on ends to pursue and on what appear as the appropriate means to attain them. But since in the market economy one’s own goals depend on the actions and intentions of others, the entire process is a “fluid” system where adjustments must be constantly made.

The adjustments are in response both to the changing plans of one’s own shifting value scale and in response to information about the actions of others. The acquisition of knowledge requires revision in one’s own plans and expectations when the activities of others affect the achieving of one’s own goals. The fact that information about incorrect expectations will be learned by market participants, and that this will almost always result in modification of plans means that the system will always have some amount of “slack,” or unemployment, that represents the adjusting for past errors.

The unemployment experienced during the trade cycle, Egger emphasized, is a symptom of a cluster or multiplication of errors and wrong expectations caused by faulty information in earlier periods of the business cycle. Credit expansion through the banking system transmits market-information signals that result in entrepreneurs rearranging production plans around capital intensive investments; workers may invest in “human capital” skills that are found to be misdirected once the malinvestments of the “boom” become visible in the readjustment period following the end or slowdown of the inflation. The artificial stimulus of investment brings about a series of “false prices” throughout the economic system. Expectations and plans have been drawn up by market actors that cannot now be fulfilled. The period of unemployment and idleness of resources is the time when the errors are sorted out and plans begin realigning around the “real” economic facts.

The political economy of privilege and power

Perhaps the most original, as well as pathbreaking work in the Austrian framework, was offered in two papers, one by John Hagel, “From Laissez Faire to Zwangswirtschaft: The Dynamics of Intervention,” and the other by Walter E. Grinder, “The Austrian Theory of the Business Cycle: Reflections on Some Socio-Economic Effects.” Hagel presented a clear and closely reasoned analysis of the steps by which the economic system moves from a relatively free spontaneous market order to one of overall state planning and control. Once the market order has been tampered with, the destabilizing effects of interventionist programs move the system further toward a regressive collectivist program. The first part of the process sees the change from a “pure market system” to “political capitalism.”

Political capitalism has three substages: the first stage involves sporadic interventions represented by subsidies, state contracts, and local monopolies; the second stage develops into a program for “rationalization” and “stabilization” of the economy and takes the form of regulatory agencies and government-assisted cartelization; in the third substage of political capitalism, there emerges a “cohesive ruling class capable of defining its own interests within the context of a broader system of political intervention.” Finally, the stage of all-round planning, Zwangswirtschaft (command economy), is reached. The mainspring of the growing interventionist state, Hagel argued, was war and inflation. War acts as a “pump priming” device to stimulate “effective demand” in times of recession brought on by previous interventions. The banking system becomes a vital link in the interventionist program, since it facilitates the expenditure activities of the government.

It is the banking link in the interventionist process that Grinder discussed in his paper. Austrian monetary theory emphasizes the fact that increases in the money supply do not affect all individuals and all places at the same time. Since such increases bring about changes in the economic positions of some people before others, Grinder said that we can see the method by which class stratification is developed·

When the Federal Reserve System directly finances the government deficit, the state becomes the first gainer because it is able to obtain access to resources that previously had been beyond its reach. The banking system is the second major gainer because of the profit opportunities from additional loans from expansion of the money supply. The third group of gainers are the contractors of government projects and recipients of government largesse. Further “gainers” from monetary expansion become hard to pinpoint without study of the particular historical circumstances, but obviously those firms that are able to borrow funds at the artificially lower interest rates obtain at least temporary gains. The banking system is the focal point for control of all major economic activities, both during the “crank-up” and “crack-up” phases of the business cycle. This segment of the economy, whose destiny is bound up with the perpetuation of interventionism, becomes the nucleus of the statist class structure. Their position as one of the biggest net gainers from monetary manipulation means their interest and future becomes more and more tightly bound up with the maintenance and growth of political capitalism, and right into the eventual establishment of fascism and Zwangswirtschaft (the command economy).

Time preference, international trade, and the market processes

Roger W. Garrison offered a creative analysis of the “Misesian Theory of Time Preference,” in which he elaborated on the logic and implications of choice and decision-making through time and the manner in which time choices pervade everything we do and the interactive exchanges into which we enter. He pointed out a variety of areas in which this “Austrian” theory of time-choices differs from mainstream, or textbook, economic analysis.

Joseph T. Salerno presented a detailed exposition of the Austrian theory of trade and exchange in which he developed an understanding of international monetary economics in terms of the demands for money and goods within and between nations that explains the coordinating process that determines foreign exchange rates. In this, Salerno drew upon the insightful but mostly neglected analysis found in Hayek’s Monetary Nationalism and International Stability (1937).

The other papers at the Symposium included Dominic Armentano’s “Competition and Monopoly Theory: Some Austrian Perspectives, Gary North’s “Three Critiques of Bureaucracy: Mises, Weber and the Counter Culture,” and J. Huston McCullough’s interpretation of “The Austrian Theory of the Marginal Use.” An additional problem was discussed in Sudha R. Shenoy’s paper, “The English Disease: An Austrian Analysis,” about the distortion in the capital structure caused by government interventionist programs in Great Britain since the Second World War.

Differing Austrianisms, interventionism, and deflation

During the evenings, a series of informal lectures were given by three of the senior commentators. Professor Kirzner shared “Some Thoughts on Austrianism in Contemporary Economics.” He discussed the then-recent revival of interest in the Austrian tradition, particularly in the works of Sir John Hicks and Erich Streissler (professor of economics at the University of Vienna). While seeing this as a favorable sign, Kirzner was not sure that the implications of Austrian analysis had been completely grasped in much of this recent work.

Leland Yeager, who in conversation said that the greatest influence on his own thinking about monetary theory had been from reading Ludwig von Mises’s The Theory of Money and Credit, lectured on the disastrous consequences of government intervention in the economy. Using a Hayekian framework, he contrasted the spontaneous market order that utilized the millions of small bits of knowledge belonging to all market participants with the attempt by the government, through regulation and intervention, to organize market activities with the few minds (and, therefore, limited knowledge) of state planners.

The most interesting and controversial of the talks was the one given by Murray Rothbard, “In Defense of Deflation.” Rothbard explained that the Chicago School notion of a stable price level was a spurious concept and not an acceptable substitute for the present policy of perpetual inflation. Instead, the inflation should be stopped and a deflationary process be allowed to run its course. Deflation would bring about the necessary “smashing” of downwardly rigid wages and prices, so the appropriate resource allocations could occur to help bring about sound long term economic activity. Also, the consumer would benefit from falling prices as productivity and purchasing power increased.

A lively debate ensued between Rothbard and Hayek about the establishment of a gold standard to guarantee that government did not manipulate the money supply. While agreeing that the gold standard was the long-term solution, Hayek said that he thought it would soon collapse again if established at the present time because no government would be willing to see the falling of prices within its boundaries, which adherence to the gold standard would probably require. Rothbard insisted that the gold standard was necessary now to “smash” the central-banking system, which was the engine of world inflation. Hayek replied that if Rothbard was talking about an international gold standard that involved the elimination of the fractional reserve system, then he (Hayek) was for it completely. This was followed by a round of thunderous applause.

The reborn Austrian School of economics

On the closing evening of the Symposium, another banquet dinner was held. The sentiments of all participants were summed up in the dinner remarks of Sudha Shenoy, who was nicknamed the Joan Robinson of the Vienna School. Addressing herself to Hayek, she said that the new generation of Austrians

shall do all that is in our power to ensure that the economic mind of the age does move with relentless logic, with consistent consistency to the priori conclusions of the Austrian system … we shall always return to the charge against the forces of macro-darkness now threatening to overwhelm the world…. I give you two toasts: to victory in the future, and to the last best legacy of Vienna to the world, Professor Hayek.

The momentum from those two Austrian conferences led the Institute for Humane Studies to sponsor a series of regional Austrian events around the United States and in Europe. In fact, there was a third Austrian conference along the lines of the second one that was held in June 1976 at Windsor Castle in England, the papers from which were published as New Directions in Austrian Economics (1978).

This also resulted in IHS sponsoring a publication series that reprinted such works as Rothbard’s America’s Great Depression, Kirzner’s The Economic Point of View: An Essay in the History of Economic Thought, which was based on his dissertation under Ludwig von Mises at New York University, Ludwig M. Lachmann’s Capital and Its Structure and The Economics of Ludwig von Mises, based on papers delivered at a session at the meeting of the Southern Economic Association in November 1974.

In addition, starting in 1976, Israel Kirzner organized and developed a graduate program in Austrian economics at New York University. This offered an entrée into the economics profession that required graduate students to fulfill all the usual graduate economic course requirements to earn a PhD while enabling the interested student to focus on the Austrian tradition while earning his doctoral degree.

Today, half a century later, after the conferences of 1974 and 1975, the Austrian School of Economics is not only fully reborn but vibrant with creative and original ideas and applications. Indeed, a good part of the success of this revival has been due to the careers and contributions of a good number of those who attended the Austrian conferences at South Royalton and Hartford. They have served as the intellectual and academic link between Ludwig von Mises and Friedrich Hayek, through Israel Kirzner and Murray Rothbard, to the present generation of younger Austrians who are continuing the Austrian tradition into the future.

This article was originally published in the July 2025 issue of Future of Freedom.

Dr. Richard M. Ebeling is the BB&T Distinguished Professor of Ethics and Free Enterprise Leadership at The Citadel. He was formerly professor of Economics at Northwood University, president of The Foundation for Economic Education (2003–2008), was the Ludwig von Mises Professor of Economics at Hillsdale College (1988–2003) in Hillsdale, Michigan, and served as vice president of academic affairs for The Future of Freedom Foundation (1989–2003)

Republished with permission from The Future of Freedom Foundation.

What do you think?

Did you find this article persuasive?